Some Known Incorrect Statements About Tax Consultant Vancouver

8 Easy Facts About Small Business Accounting Service In Vancouver Explained

Table of ContentsGetting My Small Business Accountant Vancouver To WorkGetting My Small Business Accountant Vancouver To WorkThe Facts About Vancouver Tax Accounting Company UncoveredSmall Business Accountant Vancouver Can Be Fun For EveryoneSee This Report on Vancouver Accounting Firm9 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

Right here are some advantages to hiring an accountant over an accountant: An accountant can offer you a thorough sight of your organization's economic state, together with methods as well as suggestions for making financial decisions. Accountants are just accountable for tape-recording economic purchases. Accounting professionals are required to complete more schooling, qualifications and job experience than accountants.

It can be challenging to gauge the appropriate time to employ an accountancy specialist or accountant or to identify if you need one whatsoever. While several little services hire an accountant as a specialist, you have a number of options for taking care of monetary tasks. Some little organization owners do their own accounting on software application their accountant advises or utilizes, providing it to the accountant on an once a week, monthly or quarterly basis for activity.

It may take some history research study to locate an ideal bookkeeper because, unlike accounting professionals, they are not called for to hold a professional accreditation. A strong recommendation from a trusted associate or years of experience are necessary elements when working with an accountant. Are you still not exactly sure if you require to work with someone to aid with your publications? Here are three circumstances that indicate it's time to hire an economic expert: If your taxes have ended up being also complicated to take care of on your very own, with numerous revenue streams, foreign investments, a number of reductions or other considerations, it's time to employ an accounting professional.

The smart Trick of Small Business Accounting Service In Vancouver That Nobody is Discussing

For tiny businesses, adept money administration is an important aspect of survival and development, so it's important to collaborate with an economic specialist from the begin. If you choose to go it alone, think about starting out with bookkeeping software as well as keeping your books meticulously approximately date. In this way, need to you need to hire a specialist down the line, they will certainly have exposure right into the full monetary background of your company.

Some resource interviews were performed for a previous version of this short article.

The smart Trick of Pivot Advantage Accounting And Advisory Inc. In Vancouver That Nobody is Talking About

When it comes to the ins and also outs of tax obligations, accounting and money, however, it never hurts to have a seasoned expert to resort to for guidance. An expanding variety of accounting professionals are additionally looking after things such as cash money flow forecasts, invoicing and human resources. Ultimately, much of them are taking on CFO-like roles.

When it came to using for Covid-19-related governmental funding, our 2020 State of Small Company Study located that 73% of small company proprietors with an accountant claimed their accountant's suggestions was very important in the application procedure. Accountants can additionally assist local business owner prevent pricey errors. A Clutch study of local business owners shows hop over to these guys that greater than one-third of local business listing unforeseen costs as their leading financial difficulty, adhered to by the mixing of service and individual finances and the lack of ability to receive payments on schedule. Local business proprietors can expect their accounting professionals to aid with: Picking business framework that's right for you is very important. It affects just how much you pay in tax obligations, the paperwork you need to submit as well as your personal obligation. If you're aiming published here to transform to a different organization framework, it can cause tax repercussions and also various other difficulties.

Even firms that coincide size as well as industry pay extremely different quantities for accountancy. Prior to we enter buck numbers, allow's discuss the expenses that go into small company accounting. Overhead expenses are expenses that do not straight become a profit. These costs do not convert into cash, they are needed for running your service.

Small Business Accounting Service In Vancouver Can Be Fun For Everyone

The typical expense of accountancy solutions for local business varies for every unique scenario. Yet because bookkeepers do less-involved tasks, their rates are usually more affordable than accounting professionals. Your monetary service charge relies on the job you require to be done. The average regular monthly bookkeeping fees for a small company will climb as you add more solutions as well as the tasks obtain harder.

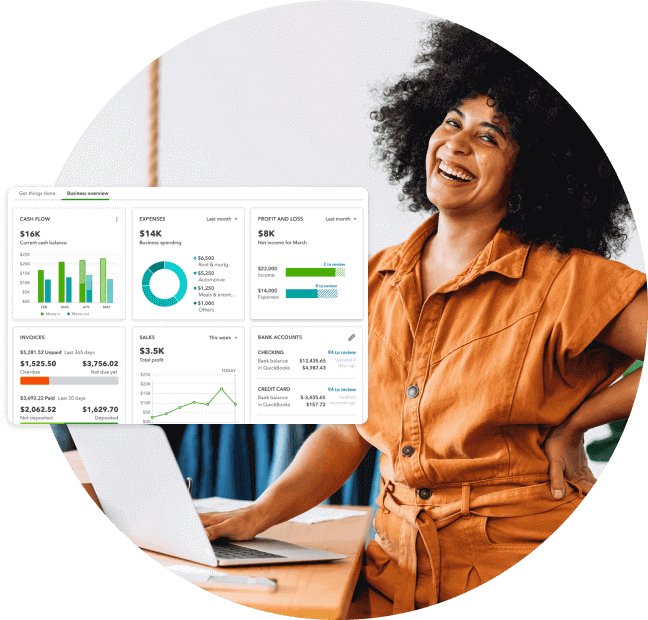

You can videotape deals and procedure pay-roll using on the internet software. Software application remedies come in all forms as well as dimensions.

:max_bytes(150000):strip_icc()/accountingmethod_definition_final_primary-resized-005e466f5d72435fbf101c5e671b1ad5.jpg)

Small Business Accountant Vancouver for Beginners

If you're a brand-new service owner, don't forget to factor bookkeeping costs into your budget plan. Administrative expenses and accountant fees aren't the only bookkeeping costs.

Your time is also beneficial and must be thought about when looking at accounting prices. The time spent on audit tasks does not create revenue.

This is not intended as legal advice; for more details, please visit this site..

Things about Vancouver Accounting Firm